When does my issue become a crisis?

13 Aug 2024

As crisis management specialists, we are often asked about the optimal time to engage a crisis communications firm. DRD Senior Associate, Rupert Bhatia, explores the answer.

As crisis management specialists, we are often asked about the optimal time to engage a crisis communications firm. The answer depends on several factors involving the issue itself, timing and those stakeholders who might be involved or affected.

Issues vs crises

Individuals or smaller businesses should have an ongoing awareness of issues that could affect their reputation. Some will engage specialists to carry out horizon scanning or even develop risk registers to track issues and classify their potential impact and likelihood.

For larger organisations, a proper register of risk is increasingly becoming a requirement with Boards seeking to demonstrate risk mitigation strategies as part of good governance. In fact, certain businesses operating within the financial services sector are mandated, by the Financial Conduct Authority, to ‘implement and maintain adequate risk management policies and procedures.’ These registers, which can sit under a Business Continuity Plan, are most effective when kept under regular review to ensure risks are evaluated accurately amid changing business landscapes.

Although there is no defined moment when issues become crises, the point of recognition is normally reflected when an issue begins having a critical impact in the ongoing operations of an organisation.

A significant number of crises have a degree of predictability and keeping a risk register – along with regular horizon scanning – can make a real difference to mitigating their effect. This activity is something DRD frequently undertakes for clients.

Indicators of a crisis include:

• An issue having critical impact on an organisation carrying on its day-to-day business. Examples might include a death; a police or judicial investigation; or a customer boycott.

• Ongoing reputational risk that impacts key stakeholders such as a significant, and sustained, drop in share price.

• Loss (or impending loss) of organisational narrative control. This is best illustrated by journalists finding new ways of keeping the issue in the news agenda.

Approaching a crisis

DRD’s work is undertaken in highly sensitive environments, often in-tandem with legal teams. Our approach to a crisis can usually be broken down into three distinct stages:

1/Preparedness

This stage typically begins with an audit of current crisis capabilities including an assessment of material internal, and external, issues and threats. Following this initial analysis, bespoke communication architecture is built to ensure the client (organisation or individual) can rapidly respond to a developing crisis. In addition, the client’s corporate materials are reviewed to ensure they are positioned to anticipate potential scrutiny from authorities including regulators.

2/Response

In the first instance, a specialist team – selected for their sectoral expertise and crisis experience – is assembled with the objective of gaining narrative control on behalf of the client. A stakeholder map is created to inform communication tactics and enable this team to manage engagement, both external and internal, at nearly all levels. In addition to real-time monitoring of all channels (including social media), a suite of key messages will be crafted with the explicit aim of moving the dial while reflecting the needs of stakeholders.

3/Recovery

Recovery differs in the aftermath of a crisis as firms and individuals face long-term challenges unique to them and their stakeholders. DRD will often advise on developing a new compliance function, conducting comprehensive reputational audits and fostering positive public engagement.

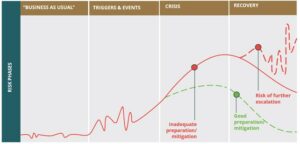

In most cases, high-quality preparedness will reduce the peak of the crisis and help streamline recovery as the below graph demonstrates.

When to engage a crisis firm

Benjamin Franklin once said, “if you fail to plan, you are planning to fail.” This sentiment holds true for crisis & issues management.

The reality is that the value of engaging a firm, like DRD, well before an issue becomes a crisis pays enormous dividends when it comes to flattening the crisis curve more quickly and ensuring an organisation can recover as rapidly as possible.